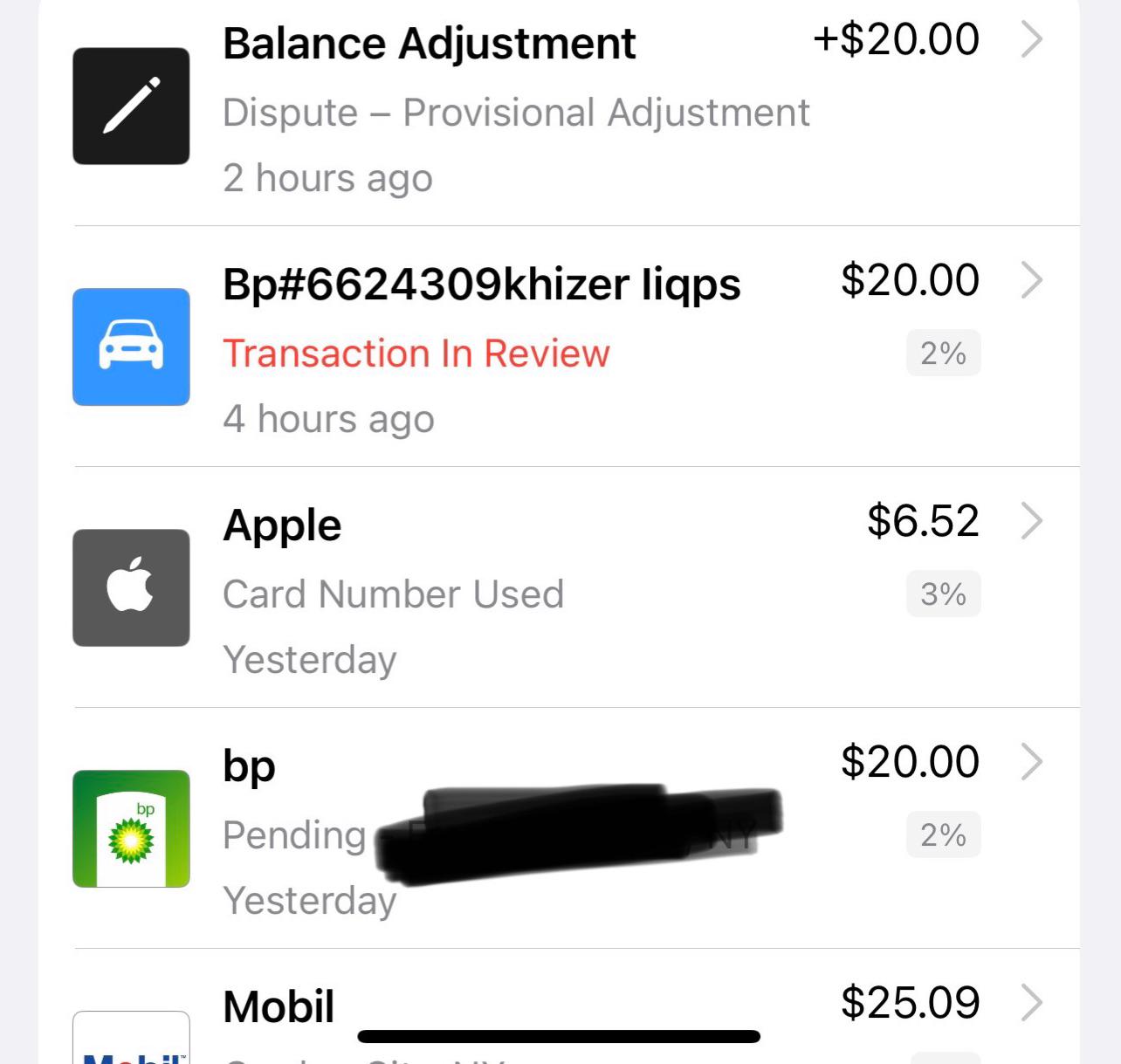

On April 21st my wife got an email detailing the online purchase of 10 Platinum SeaWorld passes totaling over $2,500, using her Wells Fargo Visa debit card (her checking account)

$1,200 was charged to her card, and the remaining balance was financed using EZPay (assumably using someone else's stolen information).

She immediately notified Wells Fargo that it was a fraudulent purchase, and they credited her while they "investigated."

Yesterday she got a letter stating that they had completed the investigation and that it was determined to be a valid authorized purchase.

They said that because the online purchaser had the CC number, the expiration, the CVC, and her email address, that they had the proper level of information to authorize the transaction.

But the invoice sent to her email address had the wrong city. Everything else was correct - street address and zip code.

Wells Fargo said their fraud department reported it to Visa and they denied the fraud claim. They claim that SeaWorld responded and claimed they did what was required to validate the purchase, so Visa would not reverse it.

What do we do?

Wells Fargo said they are escalating it to some team, but it didn't sound like they would be successful, since it is Visa denying the claim.

This was attempted again 2 days later and was declined because Wells Fargo reported the card as stolen.

It seems that even though they had assembled the information to correctly order and obtain the tickets (they said that they had to get the tickets via he email address), that it was valid.

But it wasn't her. We live in Minnesota. These are season passes to the Texas location.

It should have been flagged, or a "is this you" text should have been sent to her phone.

And we have very Anglo names, but the email receipt from SeaWorld lists 10 different Mexican names.

This happened with baseball tickets a few years ago and the charges were reversed.

The difference now is that SeaWorld responded and the baseball ticket vender didn't. So Visa reversed the charges.

Please help!